![]() Zynga filed their S1 last Friday, and while some have focused on how rich CEO Mark Pincus and his officers could become, I’ve been looking at the financials and trying to tie it back to their daily active users (DAU) to look at revenue per DAU or ARPU (Average Revenue per User) so we could have some industry benchmarks.

Zynga filed their S1 last Friday, and while some have focused on how rich CEO Mark Pincus and his officers could become, I’ve been looking at the financials and trying to tie it back to their daily active users (DAU) to look at revenue per DAU or ARPU (Average Revenue per User) so we could have some industry benchmarks.

Revenues

The S1 shows gross revenue by quarter as follows:

Q3 2009 – $31,311,000

Q4 2009 – $55,721,000

Q1 2010 – $100,927,000

Q2 2010 – $130,099,000

Q3 2010 – $170,674,000

Q4 2010 – $195,759,000

Q1 2011 – $235,421,000

Some interesting notes on this revenue figure:

- This revenue includes everything, including advertising and virtual goods, but advertising has never made more than 5% of total revenues

- The revenue figures are impacted by some accounting rules as to when the revenues can be recognized. Items that are consumables (like fuel or energy or components that are purchased and used) can be recognized within a month, while durable items (like tractors or décor that are used over time) take a longer time to be recognized (it isn’t specified in the S1, but it typically is amortized over the life of a user – for more discussion to revenue recognition, see this blog post from Bill Gurley). Zynga was only able to discern consumables versus durables starting in October of 2009, and only in one game. By January 2010, they were able to reflect this split in all games, meaning they could escalate revenue recognition. Thus it is likely that this new ability helped improve the revenue in Q4 of 2009 and Q1 of 2010. It also provides an incentive to focus games more on consumables than durables moving forward.

- Facebook Credits were implemented in their games, starting in July 2010 and completed for all games as the sole purchase currency in April of 2011. Facebook Credits take 30% of gross, and since the full implementation didn’t occur until the 2nd Quarter of 2011, we won’t see the true dampening impact on Zynga revenues in the S1 (which only covers through Q1 201).

For our purposes, I will divide the quarterly revenue by the number of days in the quarter to come up with an average revenue per day.

Daily Active Users

DAU data by game is available back to June 2009 via appdata.com, so we can at least come up with an average DAU for a quarter from Q3 2009 forward. I am not including numbers from RewardVille and the Zynga Games Bar as they don’t appear to drive revenue directly (there may be search revenue) and these are peripheral to the games (one would not go to either if they did not play at least one game).

DAU per quarter:

2009 Q3 -24,309,425

2009 Q4 -56,757,183

2010 Q1 – 66,082,862

2010 Q2 – 58,012,018

2010 Q3 – 48,975,539

2010 Q4 – 47,631,850

2011 Q1 – 59,082,981

2011 Q2 – 52,447,745

These numbers are about 2% below what Zynga reports in their S1 so it may be that Zynga is adding some DAU from platforms outside of Facebook, but that figure is relatively small (3 million at most).

The caveat of course is that the DAU figures of several games doesn’t provide you DISTINCT DAU (e.g. Zynga showed 59 million total DAU across their games in Q1 2011, including 11.7 million in FarmVille and 19.4 million in CityVille. But many users could be playing both games and thus over-stating the distinct DAU across both games). Zynga did not report distinct DAU in their S1.

So what our DAU is showing is not distinct DAU, but number of game players. Whether the user plays one or five of Zynga’s games, the Revenue divided by DAU number here shows the average revenue they see per game player.

Since Q4 2009, Zynga’s aggregate DAU is relatively flat, while Facebook’s US audience has nearly doubled in the same time period:

Of course that FarmVille peak happened in the era where developers could blatantly leverage the notifications API on Facebook. You can pretty clearly see the results now of Facebook turning off those Notifications on March 1, 2010 when you look at it by game:

From the chart above, you can see FarmVille took the biggest hit and successful games like FrontierVille couldn’t grow enough to make up the gap as users continued to decline.

CityVille gave a nice bounce in the Q1 2010, helping boost Zynga’s aggregate DAU out of the upper 40 million DAU range for the previous two quarters (the game was touted to be the first launched simultaneously in French, German, Italian and Spanish and helped it to reach 100 million MAU very quickly, but the DAU never reached that of FarmVille at it’s peak).

These numbers appear to show that there is an upper bound on the number of users playing games – that getting consistently 50-60 million aggregated game players (again, could be 20 or 30 million distinct users playing multiple games) is difficult. Even with successive releases and fast-growing games like CityVille, Zynga has not been able to get an aggregated DAU that matched the peak of FarmVille in Q1 of 2010. The impressive gains of CityVille users seems to come at the expense of their other games, like FarmVille and FrontierVille.

Faced with the prospect that there is a ceiling to the number of aggregate users, you can possibly see a benefit in the recent pattern emerging of game releases every six months (FrontierVille June 2010, CityVille December 2010, Empires and Allies June 2011): Extract every dollar from the six-month life-cycle of a game before releasing the next game. Much like game developers learn that on the Facebook platform you need to keep providing your hard core players new content and features to retain them, Zynga is playing it’s own meta version, releasing new games on a steady pace tied to when they see their users beginning to drop off.

Aggregated Revenue per DAU

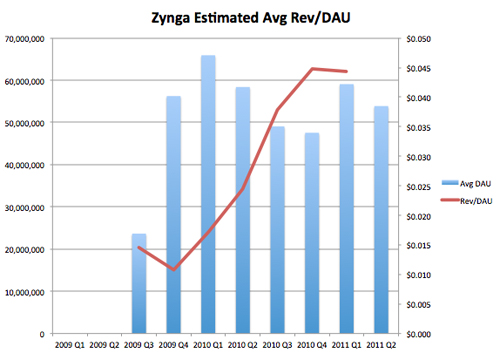

Thus the revenue per DAU by quarter shows that for the average player of a game, they’ve hit 4.4 cents in Q4 2010 and Q1 2011:

2009 Q3 $0.0145

2009 Q4 $0.0108

2010 Q1 $0.0172

2010 Q2 $0.0245

2010 Q3 $0.0378

2010 Q4 $0.0447

2011 Q1 $0.0443

Graphically you can see the trend here:

So reviewing the factors that have impacted this growth number:

- Revenue recognition of components that would have improved revenue starting Q4 2009 and fully implemented Q1 2010. Any games coming out moving forward that focus on consumables would like drive more revenue shortly after release.

- Reduced virality in games due to changes in the platform (such as removing Notifications on March 1, 2010 and a severely dampening wall posts in September 2010). This actually may have left games with only their more hard core users and thus better monetization, but also resulting in a shorter lifetime of games as it became more difficult to back-fill those users that churn off the game.

- The impact of Facebook Credits integration – a dampening impact from Q3 2010 to Q1 2011 but whose full impact we wont see until Q2 2011, but that could explain why the successive quarter-to-quarter growth in ARPU declined slightly in Q1 2011 after four successive quarters of growth

- The success of game releases in driving better revenue per user and the percentage of aggregate DAU that each game makes. It’s well-known that Zynga optimizes everything and there is learning from game to game. In addition, if a larger percentage of your game players were playing Café World or YoVille (arguably poorer performers because they predominately focus on decorations which are durables and the difficulty of getting users to redecorate), then that impacts the aggregate number. Migrate Café World and YoVille daily users to newer games like FrontierVille and CityVille (which have more consumables and mechanics that drive a user to pay), and that can possibly increase the aggregate revenue per game player figure as well.

Is 4.4 cents per game player per day the holy grail for a mass market Facebook game (as opposed to RPGs which have smaller audiences but higher revenue per player)? Getting users to play every day and across multiple titles is key to driving customer lifetime value and insight into those numbers are lacking from the S1. Their most visible efforts at cross-game promotion and retention (RewardVille getting 1.25 million users per day) suggests that about 2.2% of users are engaged each day).

With Zynga DAUs declining in Q2, will they be able to match the quarter over quarter revenue growth? Will their latest game Empires and Allies, with a slightly more RPG style, provide enough additional revenues to make up the DAU gap? And if it doesn’t, will Zynga push ahead another release before December?

We will have to wait for more quarterly reporting to get a feel, but for now the 4.4 cents per day per user is a handy benchmark.

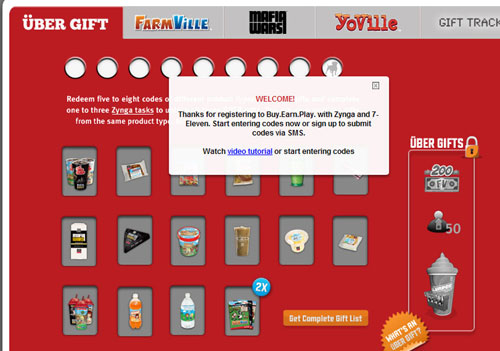

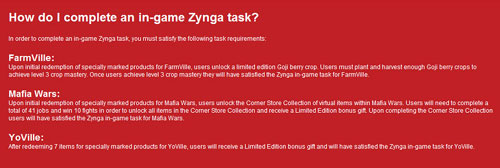

Users need to achieve Level 3 Mastery of a special crop in FarmVille, which seems a lot harder than doing 41 jobs and winning 10 fights in Mafia Wars (and actually no in-game task for YoVille). While these seem skewed, they actually seem to match the value of the UberGift unlocked in each game: 200 FarmVille cash, 50 Reward Points for Mafia Wars, and a Slurpee Machine for your YoVille pad.

Users need to achieve Level 3 Mastery of a special crop in FarmVille, which seems a lot harder than doing 41 jobs and winning 10 fights in Mafia Wars (and actually no in-game task for YoVille). While these seem skewed, they actually seem to match the value of the UberGift unlocked in each game: 200 FarmVille cash, 50 Reward Points for Mafia Wars, and a Slurpee Machine for your YoVille pad. As Playdom’s new Social City continues to grow at a fast rate — it jumped into the top 20 applications by daily active users (DAU) by surpassing the 2.5 million mark – it doesn’t take Zynga long to ensure that it’s throwing a similar city-themed game into their portfolio. It’s very likely Zynga has been working on a Sim City-style game of its own for a while and they’ll be tracking down and out-marketing and out-spending their competitors much like they did with CrowdStar (it took 58 days to surpass Happy Aquarium when they launched FishVille) and Playfish (it took eight days to surpass Restaurant City after launching Café World, 36 days to surpass Pet Society after launching PetVille).

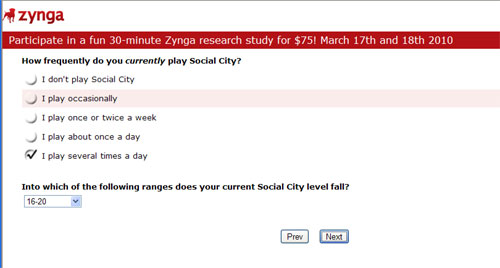

As Playdom’s new Social City continues to grow at a fast rate — it jumped into the top 20 applications by daily active users (DAU) by surpassing the 2.5 million mark – it doesn’t take Zynga long to ensure that it’s throwing a similar city-themed game into their portfolio. It’s very likely Zynga has been working on a Sim City-style game of its own for a while and they’ll be tracking down and out-marketing and out-spending their competitors much like they did with CrowdStar (it took 58 days to surpass Happy Aquarium when they launched FishVille) and Playfish (it took eight days to surpass Restaurant City after launching Café World, 36 days to surpass Pet Society after launching PetVille). The first sign something is afoot is a bevy of ads launched on Facebook today by Zynga (featuring characters from FarmVille, Mafia Wars and Café World) looking for users to help “tell us what you think…makes a great social game?” This launches a user into a pre-screening survey, looking to recruit users to do a 30-minute interview over the phone (and in front of their PC using screen-sharing technology).

The first sign something is afoot is a bevy of ads launched on Facebook today by Zynga (featuring characters from FarmVille, Mafia Wars and Café World) looking for users to help “tell us what you think…makes a great social game?” This launches a user into a pre-screening survey, looking to recruit users to do a 30-minute interview over the phone (and in front of their PC using screen-sharing technology).