With the release of PetVille last week, one of the more notable changes is that Zynga stopped cross-promoting Texas Hold’em Poker, signaling that Zynga is continuing to move away from the synchronous games of its early days and dedicating its resources more fully on asynchronous games.

I generally think of Zynga going through three game development stages:

Stage One – Turn-based social games

- Key games: Scramble, PathWords, Word Twist, Sodoku, Attack!

- These games were fairly popular in the days of Scrabulous, but head-to-head play among friends was often a waiting fiasco: Users came on at different points in the day for a asynchronous session and would have to wait for others in a game to finally log on and take their turn before game play could proceed.

Stage Two – Testing Three Paths: Asynchronous, Synchronous and Sim Games

- Key games: Mafia Wars, Texas Hold’em and YoVille

- Mafia Wars created the ability to leverage those short, multiple-times-a-day user sessions and provide a core asynchronous play style that was duplicated in a multitude of titles (Gang Wars, Space Wars, Dragon Wars, Street Rcing, Fashion Wars, Vampire Wars, Special Forces, Dope Wars, Pirates)

- Texas Hold’em (eventually renamed Zynga Poker) invested heavily in a robust lobby system, allowing users to join other Facebook users not in their network in synchronous play

- YoVille was also developed in this period (my understanding that this was actually developed externally and purchased by Zynga) providing a valuable learning experience about what worked in sim games.

Stage Three – The Rise of Sim Games and Games as a Service

- Key games: FarmVille, FishVille, PetVille, Café World, Roller Coaster Kingdom

- Short game play with appointment gaming mechanisms that are all asynchronous and built for a more broad audience

- Interestingly, all of these games have origins from other Facebook titles, except Roller Coaster Kingdom, which actually has had the most difficulty in terms of creating growth and a high sticky factor (relative to the hyper growth of the other titles in this stage). In fact, Roller Coaster Kingdom was actually dropped from cross promotion when FishVille launched.

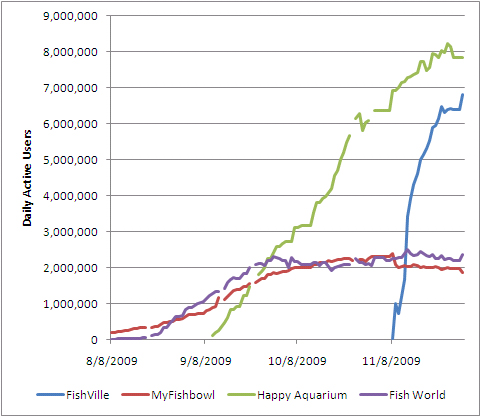

So why drop Texas Hold’em (currently # 11 in DAU)? I thought I’d look at the growth factors of the Stage Two games since the introduction of FarmVille in late June till the beginning of this month (using data through December 6th) to see how this rapidly growing new audience is taking in the older games. In this table, I look at the marginal growth in DAU and MAU since FarmVille’s launch:

| Game |

Additional DAU |

% DAU growth |

Additional MAU |

% MAU growth |

Implied Sticky Factor |

| Mafia Wars |

3.30 million |

94% |

14.15 million |

124% |

21.8 |

| YoVille |

2.01 million |

143% |

11.26 million |

144% |

17.9 |

| Texas Hold’em |

1.83 million |

67% |

6.12 million |

44% |

29.9 |

Not surprisingly, YoVille’s similar game play style has afforded it the biggest growth among these games. In comparison, Texas Hold’em has had the smallest increase in DAU and MAU (although to be fair, the poker game had a higher base MAU of 13.8 million compared to 12.2 million for Mafia Wars and 7.8 million for YoVille at the time FarmVille launched) and seemed to benefit the least from the rise of the new sim games.

Dropping Texas Hold’em Poker from cross-promotion toolbars really seems to come down to two key points: demographics and synchronous vs. asynchronous game play. Speaking generally, Poker skews heavily male and is more of a niche (5% of the US plays poker online and players are 74% male between the ages of 26-35 according to industry data). These Stage Three games are much more casual games by nature, which traditionally has a female skew and slightly older audience.

More importantly, Poker is truly a synchronous game play mechanic – you have to have other people to play against online at the same time with you – where all of the other games have a core asynchronous game mode that make them more similar and likely more successful as cross-promotions.

Can Synchronous Game Play Thrive on Facebook?

It has been widely believed that Poker was one of the key revenue drivers for Zynga (especially prior to the release of FarmVille or growth of Mafia Wars), so I doubt Zynga will put its Poker game out to pasture. Indeed, all the major developers have their hat in the ring with poker: Playfish has recently joined the fray, launching Poker Rivals and Playdom has about 150,000 DAU using it’s Poker Palace.

Beyond poker, there is a rich history of synchronous multiplayer games especially in cards (from Bill Gates playing Bridge with users in the community on MSN’s old Zone game portal to groups gathering to play Gin together on Wednesday nights on Pogo.com), suggesting that there is a definite audience and opportunity here.

But the challenge is that in these examples you largely play a pick-up game with strangers: there is always a group of players online and enough of a pool to always start a game. In contrast, Facebook relies on the strength of your social network, and many of your friends are not online at the same time, making the pool of available players who have the same interest in playing a specific game very small.

Take a look at how many people appear in your Facebook chat window – I’d guess that at any one time you’ll have at most 10-15% of your friends available. Then think about what percentage of those friends will actually want to play the same game with you? It’s small, thus there is a need to somehow, safely, branch out beyond your friends to play.

Playing with Strangers

There is already a compliment of multiplayer games (other than poker) on Facebook that involve synchronous play with strangers (e.g. the Stage One Zynga games, GameHouse’s Uno, and Large Animal Game’s Bananagrams), but they are all relatively tiny compared to the 4.5 million DAU for Texas Hold’em – in fact many have 100,000 DAU or less.

Interestingly, the applications with the largest audiences where strangers are playing together may actually be the top asynchronous games. Games like FarmVille and MafiaWars have required users to have a certain number of friends in the application to unlock different levels or content (in some cases those items or levels can be unlocked with cash).

Interestingly, the applications with the largest audiences where strangers are playing together may actually be the top asynchronous games. Games like FarmVille and MafiaWars have required users to have a certain number of friends in the application to unlock different levels or content (in some cases those items or levels can be unlocked with cash).

While not explicitly pushing users to play with strangers, you can go to any game’s fan page and see users comments to a developer post that look like a stream of “Add Me” requests – pushing users to add total strangers so they can advance in the game.

For the full analysis, including discussions of synchronous gameplay on Facebook and the practice of friending strangers to get ahead in a game, see the full post at InsideSocialGames.com

Interestingly, the applications with the largest audiences where strangers are playing together may actually be the top asynchronous games. Games like FarmVille and MafiaWars have required users to have a certain number of friends in the application to unlock different levels or content (in some cases those items or levels can be unlocked with cash).

Interestingly, the applications with the largest audiences where strangers are playing together may actually be the top asynchronous games. Games like FarmVille and MafiaWars have required users to have a certain number of friends in the application to unlock different levels or content (in some cases those items or levels can be unlocked with cash).