As originally posted on Inside Social Games

As originally posted on Inside Social Games

Every year around this time, when I was selling casual download games across the Oberon Media distribution platform, we’d see the numbers of games sold begin to decline: disposable income and leisure time tend to dry up as everyone gears up for Christmas.

And so after months of impressive growth, some of the biggest games on Facebook are reflecting what could be a similar seasonal trend on the social platform – virtually every big game has seen a decline in their Daily Active Users (DAU) since their peaks in December:

| Game | High DAU Date | Dec High DAU | Dec 21 DAU | % Decline |

| FarmVille | 8-Dec | 28,168,448 | 26,240,616 | -7% |

| Café World | 4-Dec | 10,714,586 | 9,079,596 | -15% |

| Happy Aquarium | 5-Dec | 8,169,204 | 7,070,370 | -13% |

| FishVille | 5-Dec | 7,459,387 | 6,644,904 | -11% |

| Mafia Wars | 9-Dec | 7,021,764 | 5,574,330 | -21% |

| Zynga Poker | 17-Dec | 5,013,652 | 4,773,945 | -5% |

| Pet Society | 9-Dec | 5,094,052 | 4,753,688 | -7% |

| Restaurant City | 8-Dec | 4,680,805 | 4,113,377 | -12% |

| Farm Town | 10-Dec | 5,374,337 | 4,110,261 | -24% |

| YoVille | 8-Dec | 3,463,083 | 2,833,933 | -18% |

| Bejeweled Blitz | 11-Dec | 3,175,528 | 2,783,245 | -12% |

| Happy Pets | 13-Dec | 2,977,222 | 2,768,133 | -7% |

| My Fishbowl | 8-Dec | 1,956,719 | 1,911,330 | -2% |

| Roller Coaster | 1-Dec | 2,323,788 | 1,474,539 | -37% |

| Lil Farm Life | 16-Dec | 1,427,667 | 1,232,698 | -14% |

Collectively, these games have fallen 12.0% from their monthly highs, dropping from 97.0 million DAU to 5.3 million on December 21. A Facebook platform issue that impacted all applications for 48 hours starting December 9 might also have pushed users to give up the games and focus on their holiday shopping in earnest. In addition, some of these titles have had extenuating circumstances that might have caused the variances. Mafia Wars retooled their infrastructure and put in anti-hacking measurements massively impacting the game’s DAU. In contrast, Pet Society launched a new lottery feature to drive users to return every day and helped improve DAU.

Yet because the decline is pretty consistent across multiple developers and game types, it’s reasonable to attribute these declines to the seasonal trends I’ve experienced in the casual game download space. Still, could it be a bit more ominous signs of a slowing in Facebook’s growth? Or signs that games are maturing and life cycles are declining as more games enter the market?

Are There Other Factors Beyond Seasonal Trends?

There is no question that social games growth has mirrored the massive increase in Facebook subscribers – Facebook has added over 100 million monthly active users (MAU) in the six months that FarmVille has grown to just short of 75 million MAU. Having a continual influx of new users makes it relatively easy to continue growing the game.

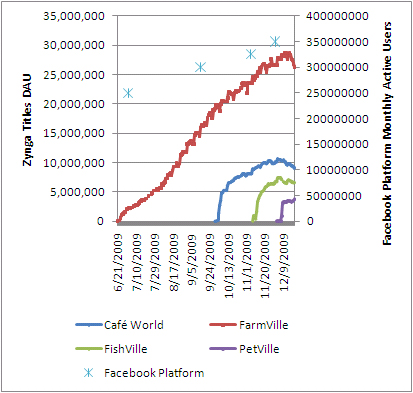

The pace of Facebook monthly active users seems pretty consistent (at least for numbers reported through November). But what is really interesting in the graph above is comparing the relative progressions of each of the most recent Zynga releases.

FarmVille is by far the fastest growing and in general has been able to maintain its growth. The successive titles of Café World, FishVille and PetVille all appear to have smaller initial trajectories and then to plateau at a certain level, each one slightly below the former release.

This is reminiscent of the casual download space, where a developer would release a genre-defining title, like Diner Dash, and then churn out successive titles based on that mechanic. Each one had some initial huge boost in interest and sales, but over time the games held user interest (in terms of spending money to buy the title) for shorter periods of time and typically at a lesser number of units.

It is still early in the social games life cycle and the numbers for these games are still in their early stages and it’s probably too early to say they are on their decline – Café World only Monday released achievements in the game, which based on examples of Mafia Wars and FarmVille helped boost the sticky factors in each game.

If the casual download game space can provide any insight on this trend, it will come the week after Christmas. Once Christmas is passed and users break out new computers or have holiday money to spend, the sales of PC download games usually rebound – and I’d expect the DAU for top games to start their upward swing again.

And if the numbers don’t rebound? We may get some interesting insights into the life cycle of a social game.

Interesting as always Eric!